Directors' Remuneration Report

STATEMENT FROM CHAIRMAN OF THE REMUNERATION COMMITTEE

We have presented the remuneration report for the year to 31 December 2014 in accordance with the regulations governing the disclosure and approval of Directors’ remuneration. The report has been divided into two parts:

- Directors’ Remuneration Policy, which was approved by shareholders at the Company’s AGM on 10 April 2014 and will be submitted to shareholders for approval every three years thereafter;

- Annual Report on Remuneration, which provides information on how the policy has been applied during the yearand which will be subject to an advisory resolution at the forthcoming AGM.

In preparing the report the Committee has taken into account guidance on directors’ remuneration reporting from the GC100 and Investors Group.

The role of the Remuneration Committee is to seek and retain the appropriate calibre of people on the Board and recommend fee levels to the Board consistent with prevailing market conditions, peer group companies and Directors’ roles and responsibilities.

The Committee met once during the year. The Committee concluded that annual benchmarking of the remuneration of non-executive directors should be conducted by means of comparison with a small number of comparable companies with effect from 2015.

DIRECTORS’ REMUNERATION POLICY

The Company’s policy is to pay each Director a fixed fee per annum commensurate with the level of commitment required and prevailing rates informed by external consultants and comparable organisations. Additional responsibility, such as that of the Chairman, is rewarded by a fixed additional sum and expenses incurred in connection with the Company’s business are reimbursed.

This Remuneration Policy was approved by shareholders at the Company’s AGM on 10 April 2014. Accordingly, the Remuneration Policy provisions set out below will apply until they are next put to shareholders for renewal of that approval, which must be at intervals of not more than three years, or the Remuneration Policy is varied, in which case, shareholder approval for the new Remuneration Policy will be sought.

The Company has no employees and therefore pay and employment considerations are not taken into account in determining Directors’ fees, nor does it determine executive pay. No component of any Director’s remuneration is subject to performance factors. The Committee determines appropriate levels of remuneration for all Directors’ fees, subject to the overall limit as set out in the Articles of Association of £500,000.

The table below shows the rates of annual fees paid to non-executive Directors for the year ending 31 December 2014. Fees for 2015 are currently under review.

|

Component |

Director |

Sum |

|

Annual fee |

All Directors |

£30,000 |

|

Additional fee |

Chairman of the Board |

£10,000 |

|

Additional fee |

Chairman of the Audit Committee |

£6,000 |

|

Expenses |

All Directors |

n/a |

Recruitment and remuneration policies

- The Committee seeks to attract and retain high calibre Directors by offering a market competitive fee level. The level of the fee is reviewed periodically by the Remuneration Committee, with reference to market levels at other companies having similar profiles to that of the Company, and consultation with third party advisors. A recommendation is then made to the Board.

- The Company has no employees. Accordingly, there are no differences in policy on the remuneration of Directors and the remuneration of employees.

- No Director is entitled to receive any remuneration which is performance related. As a result there are no performance conditions in relation to any elements of the Directors’ remuneration in existence to set out in this policy.

- The remuneration package for any new Chairman or non-executive Director will be the same as the prevailing rates determined on the bases set out above. The fee and entitlement to reclaim reasonable expenses is set out in the Directors’ Letter of Appointment.

- The Company will not pay any introductory fee or incentive to any person to encourage them to become a Director, but may pay fees to search and selection consultants in connection with the appointment of any non-executive Director.

- Having appointed Phil Holland as Finance Director and Deputy Managing Director on 17 February 2015, the Company only intends to appoint non-executive Directors for the foreseeable future.

- The maximum aggregate fee currently payable to all Directors is £500,000.

There have been no changes to the Company’s remuneration policy for Directors since the publication of the last Annual Report of the Group.

Service contracts

No Director has a service contract. The contract for the services of Harry Hyman is with Nexus, pursuant to the Advisory Agreement. There are letters of appointment in place for the other Directors including the Chairman. These provide, subject to the appointment and any re-appointment being in accordance with the terms of the Articles of Association and to retirement by rotation, that Directors are appointed for an initial turn of three years and that such appointment can be terminated upon either party giving not less than three months’ prior written notice, with no compensation for loss of office. These letters of appointment are available for inspection at the Registered Office and at the AGM.

All Directors are subject to re-appointment by Shareholders at the first Annual General Meeting held after their appointment and annual re-election thereafter in accordance with Code Provision B.7.1.

Loss of Office: Directors do not have any entitlement to payment upon loss of office over and above the pro-rated fees due to them and any outstanding expenses.

Scenarios: as the Directors’ fees are fixed at annual rates, there are no other scenarios where remuneration will vary. It is accordingly not considered appropriate to provide different remuneration scenarios for each Director.

Statement of consideration of conditions elsewhere in the Company: as the Company has no employees, the process of consulting with employees on the setting of the Remuneration Policy is not relevant.

Other items

None of the Directors has any entitlement to pensions or pension related benefits, medical or life insurance schemes, share options, long-term incentive plans, or performance related payments. No Director is entitled to any other monetary payment or any assets of the Company except in their capacity as shareholders of the Company.

Director’s and Officer’s liability insurance cover is maintained by the Company, at its expense, on behalf of the Directors.

ANNUAL REPORT ON REMUNERATION

This part of the report has been prepared in accordance with Part 3 of Schedule 8 of The Large and Medium-sized Companies and Groups (Accounts and Reports) Regulations 2013, and relevant sections of the Listing Rules. The annual report on remuneration will be put to an advisory shareholder vote at the 2015 AGM. The information on pages 41 to 44 has been audited where required under the regulations and indicated as audited information where applicable.

The Remuneration Committee determines appropriate levels of remuneration for all Directors’ fees as set out in the Articles of Association. The Committee makes recommendations to the Board as a whole and no Director is involved in any decision regarding his own remuneration. Directors’ fees were last reviewed on 1 January 2014. The set fee for each Director is currently £30,000 per annum and £40,000 per annum for the Chairman. The Audit Committee Chairman receives an additional £6,000 per annum.

The Directors who served during the year received the following fees:

Single total figure of remuneration (audited information)

|

Year ended 31 Dec 2014 |

Year ended 31 Dec 2013 |

|

|

Graeme Elliot1 |

£20,000 |

£36,000 |

|

Alun Jones2 |

£39,000 |

£33,000 |

|

Harry Hyman (Managing Director) |

£30,000 |

£27,500 |

|

James Hambro |

£30,000 |

£27,500 |

|

William Hemmings |

£30,000 |

£27,500 |

|

Dr Ian Rutter |

£30,000 |

£27,500 |

|

Mark Creedy |

£30,000 |

£27,500 |

|

Steven Owen3 |

£34,348 |

- |

|

Total |

£243,348 |

£206,500 |

- Payment in role as Chairman until retirement on 10 April 2014

- Payment as Chairman of Audit Committee from 1 January 2014 to 10 April 2014 and as Chairman from 11 April 2014

- Payment as a Director from appointment in 1 January 2014. Additional fee paid from 11 April 2014 following appointment as Chairman of Audit Committee

Harry Hyman is a Director of Nexus, the Adviser to the Group. The fees in respect of the services of Mr Hyman are paid to Nexus. The Advisory Agreement provides for the first £100,000 of the adviser fee to be payable to Nexus each year in respect of the services of the Managing Director.

James Hambro is a Director of J O Hambro Capital Management Holdings Limited, the holding company for JOHCM. Until the termination of its service agreement on 30 April 2014, JOHCM were a joint adviser to the Group. For the period from 1 January 2014 to 30 April 2014, Mr Hambro’s entitlements to Directors’ fees (which are the same as other Directors) were paid to JOHCM.

The fee in respect of Mr Hemmings’ services as a Director is paid to Aberdeen Asset Management PLC.

The fee in respect of Mr Owen’s service as a Director is paid to Oakland Ventures Limited.

The Company has not complied with Code provision D.1.2 and has not disclosed the amount of fees received by the Managing Director in respect of his other non-executive Director appointments. Since he is committed to working a certain number of days a month for this Company, this amount is not deemed relevant and the Remuneration Committee is satisfied that the Company received the appropriate time commitment from the Managing Director.

Further details of the Advisory Agreement are given in the Directors’ Report on page 46 and details of the amounts paid to the Adviser in Note 4 to the financial statements.

Non-executive Directors are not eligible for bonuses, pension benefits, share options, long-term incentive schemes or other benefits. Directors may be reimbursed for travel and accommodation expenses in connection with Board Meetings and in line with the Group’s expense policy.

COMPANY'S PERFORMANCE

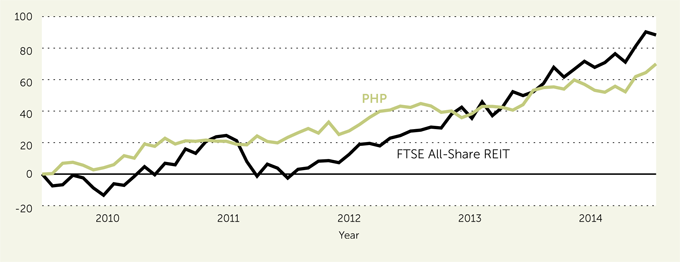

The following graph compares, over a five year period, the total Shareholder return (as required by Company Law) of the Company’s Ordinary shares relative to a return on a hypothetical holding over the same period in the FTSE All- Share Real Estate Investment Trust Index. This Index has been chosen by the Board as the most appropriate in the circumstances. Total Shareholder return is the measure of returns provided by a company to Shareholders reflecting share price movements and assuming reinvestment of dividends.

For the year ended 31 December 2014, the highest and lowest mid-market price of the Company’s Ordinary Shares was 370p (high) and 328p (low) respectively.

RELATIVE IMPORTANCE OF SPEND ON PAY

The following table shows the total remuneration paid to Directors and total management fees paid compared to the dividends paid to shareholders:

|

2014 |

2013 |

Difference |

|

|

Directors’ fees1 |

£243,348 |

£206,500 |

£36,848 |

|

Management fee |

£5,345,000 |

£4,887,000 |

£458,000 |

|

Dividends |

£21,651,318 |

£16,518,350 |

£5,132,968 |

- As the Company has no employees the total spend on remuneration comprises just the Directors’ fees.

Note: the items listed in the table above are as required by the Large and Medium-sized Companies and Groups (Accounts and Reports) (Amendment) Regulations 2013 s.20 with the exception of the management fee which has been included because the Directors believe it will help shareholders’ understanding of the relative importance of the spend on pay. The figures for this measure are as shown in Note 4 to the financial statements.

The interests of the Directors in the share capital of the Company (all of which are beneficial unless otherwise stated) and any interests of a person connected with a Director (within the meaning of the Disclosure and Transparency Rules) are shown below:

|

Audited |

31 Dec 2014 |

31 Dec 2013 |

|

Mark Creedy |

12,000 |

12,000 |

|

Mark Creedy (non-beneficial) |

635 |

635 |

|

James Hambro |

48,857 |

48,857 |

|

James Hambro (non-beneficial) |

- |

503,327 |

|

William Hemmings |

5,937 |

5,266 |

|

Harry Hyman |

638,525 |

72,640 |

|

Harry Hyman (non-beneficial) |

3,463,450 |

4,023,357 |

|

Alun Jones |

22,500 |

22,500 |

|

Steven Owen |

8,718 |

- |

|

Dr Ian Rutter |

9,619 |

9,144 |

Save as disclosed below, no changes occurred between 31 December 2014 and the date of this Report.

Mr Hyman and Mr Hemmings are participants in the Company’s monthly investment account that is administered by Equiniti on the Company’s behalf. As a consequence of this participation, at the date of this Report Mr Hemmings’ beneficial interest had increased to 5,988 shares and Mr Hyman’s to 638,627 shares.

At the date of this report, Mr Holland held 6,734 shares in the Company.

STATEMENT OF SHAREHOLDER VOTING

At the 2014 AGM, shareholder voting on the remuneration report was as follows:

|

Remuneration Report |

No of shares |

% of votes cast |

|

Votes cast in favour |

33,786,979 |

99.70 |

|

Votes cast against |

101,738 |

0.30 |

|

Total votes cast |

33,888,717 |

100.00 |

|

Abstentions |

429,399 |

1.25 |

|

Remuneration Policy |

No of shares |

% of votes cast |

|

Votes cast in favour |

33,775,226 |

99.69 |

|

Votes cast against |

103,389 |

0.31 |

|

Total votes cast |

33,878,615 |

100.00 |

|

Abstentions |

439,501 |

1.28 |

APPROVAL

The Directors’ remuneration report, including both the Directors’ Remuneration Policy and the Annual Report on Remuneration has been approved by the Board of Directors.

Signed on behalf of the Board of Directors.

Dr Ian Rutter

Chairman of the Remuneration Committee

18 February 2015