Business Model

The Group works in partnership with its stakeholders to create and maintain a portfolio of fit for purpose facilities that provide a long term home for local healthcare provision and that are easily adapted to meet the changing needs of a community. Initial lease terms are typically of 21 years or more, at effectively upward only rentals and the large majority of income is received either directly from the NHS or from NHS funded GP tenants providing a secure, transparent income stream.

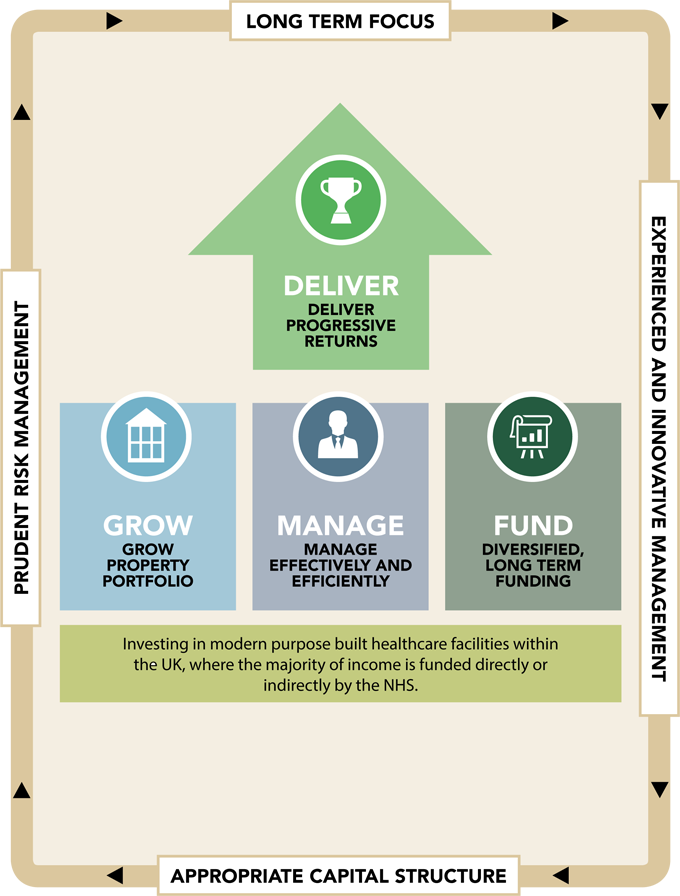

By successfully achieving each of the strategic objectives outlined below PHP is able to meet its overriding aim of delivering progressive shareholder returns through a combination of income and long term value growth.

- The Group looks to grow its property portfolio by funding and acquiring high quality newly delivered facilities and investing in already completed, let properties. PHP concentrates on assets with strong underlying fundamentals that it can acquire for a fair price and secure an acceptable gap between the income yield an asset generates and the cost of managing and funding that investment.

- Each potential investment is evaluated for its income and asset value growth potential. PHP seeks to manage its portfolio effectively and efficiently, looking to identify opportunities to add income and value by providing additional space, facilitating the provision of additional services or extending the term of underlying leases. This is undertaken within an efficient management structure where operating costs are tightly controlled and structured to gain economies of scale as the Group continues to grow.

- The Group finances its portfolio with a diversified mix of equity and debt, in order to optimise risk adjusted returns to shareholders. Debt facilities are arranged on both a secured and unsecured basis, provided by traditional bank lenders and debt capital markets and with a spread of maturities that ensures flexibility and availability over the longer term to match the longevity of income streams.

- PHP recognises that effective management of risks faced by its business is key to its ability to achieve its strategic objectives. PHP takes a long term view of its business, in keeping with the strategic horizons of its tenants and length of its income streams. The portfolio is managed by an experienced and innovative management team and funded within an appropriate capital structure. Through a well-defined system of robust risk management, the Board monitors internal and external risks and actively manages the potential impact and possible opportunities they create.