Market Backdrop

OUR MARKET

PHP is a long term investor in modern purpose-built healthcare properties located within the UK. Tenants comprise of general practitioners, NHS organisations and other associated healthcare users, including on-site pharmacies.

THE OPPORTUNITY

Primary care is the foundation of the NHS in the UK and the GP continues to be the first point of access to healthcare services for UK residents other than acute emergency care. More than 1.3 million patients visit their GP practice each day1, representing 90% of all NHS patient contacts. The recent five year plan published by the NHS reiterated that “the foundation of NHS care will remain list-based primary care” and the provision of more GPs is a stated objective of each of the three main political parties.

The latest available data2 shows that across the UK there are more than 43,000 GPs, operating within 9,700 partnerships. Alongside mostly GP occupied premises, there are a growing number of directly NHS tenanted primary care facilities that house outpatient departments, provide urgent care centres and other such services that are being relocated into the community which they serve.

The NHS England Five Year Plan commits to invest more in primary care and provide more services within the local community. Here, these services can be delivered more cost effectively and provide greater choice to the patient.

This change in delivery requires modern, purpose built flexible premises from which these services can be provided, whereas a large part of the primary care estate is comprised of ageing, converted residential properties with 40% of GPs seeing their properties as being inadequate for the provision of general practice services3. In December 2014, the Government announced £1.1 billion in funding over the next four years specifically to improve GP premises, but in order to fund the large scale investment that is required to properly modernise the primary care estate, investment capital from private sector investors such as PHP will be in demand.

THE FUNDAMENTALS

Patient driven demand

The UK’s population is growing and ageing. In 2013, the UK’s population was 64.1 million, with 7.6 million people aged 70 or over4. The total population is projected to grow by 10% in the next 15 years, but the number over the age of 70 will grow by more than 45%. This will bring with it ever increasing and changing demands both in terms of providing the range of services needed by the population, but also in order to generate delivery efficiencies, for the continued viability of the NHS.

The policy of integrating of local authority social care and health and wellbeing services with primary care will only increase the need for further flexible, but community based premises.

Strong property characteristics

The primary care premises market is tightly controlled by the NHS, meaning there is no speculative development of new facilities. Structural changes in the NHS in 2013 have led to a significant reduction in the number of approvals since that time. Now that new management systems and processes have been put in place and with the announcement of additional funding, we anticipate an increase in new approvals in the near future.

Buildings are often located within residential areas which can lead to restricted alternative use potential. Against this, initial lease terms are longer than in general commercial markets, more than 20 years on average, have no break terms and benefit from a shorter rent review cycle, typically three yearly and in general on an upwards only basis.

A key feature of the sector is that GPs receive reimbursement for costs associated with their premises from the NHS, a practice that is set out in legislation. Where properties are leased from landlords such as PHP, a GPs rent and costs of maintaining and insuring the property are funded by the NHS. Together with leases direct to the NHS, the sector benefits from a very strong underlying rental covenant.

These factors combine to create a long term, low risk income environment where over the medium term, through a mix of indexed linked and open market review characteristics, rental growth has broadly tracked inflation.

RETURNS

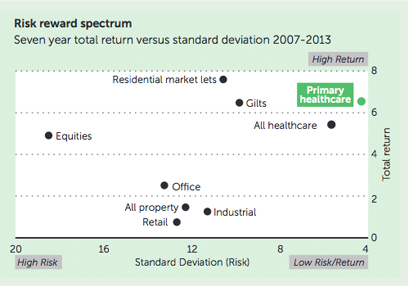

IPD established its Healthcare Property Index in 2007 which is published in March each year. The chart to the right shows how the primary healthcare real estate sector has produced superior returns over the life of the index. This reflects the low risk nature of its tenants and lower volatility in capital values underpinned by the long term nature of the income streams, generating a very compelling investment case.

Source:IPD

- Royal College of General Practitioners January 2015.

- Office for National Statistics.

- British Medical Association GP Committee Premises Survey.

- Office for National Statistics.